Datanamix Batch Verification service can benefit your business’s client KYC (Know Your Customer) process when onboarding or performing account management on your customers, by reducing costs and utilising resources better. This will allow your company and employees to save a substantial amount of time and focus on other more important business tasks like making a profit.

Ready to learn the ins and outs of Batch Verification? Let’s dive in:

What is batch verification?

Batch verification is a process that allows companies to verify a large amount of customer data quickly and accurately from verified golden sources. Batch data can include data from sources such as Home Affairs, CIPC, and Bureau data for the latest contact and address information for KYC. Other data verification services such as AML (Anti-money Laundering) Sanction screening, source of funds and industry classification are also available.

Why is batch verification important?

The rules regarding FICA* (Financial Intelligence Centre Act) and KYC* are highly regulated in South Africa, requiring businesses to perform periodic KYC update reviews of their client data according to a company’s RMCP* (Risk Management and Compliance Programme) policy. Businesses that are discovered by the Prudential Authority to be non-compliant could face substantial financial penalties, along with significant reputation damage.

For numerous companies, ensuring adherence to FICA regulations and maintaining accurate and up-to-date records for their numerous customers is an enormous undertaking, and a lot of them struggle to meet the requirements. Batch Verifications allow a company to remain compliant with the FIC Act throughout the period that a customer stays with the company.

How does our batch verification work?

In a few simple steps, your business can do a batch verification;

- A business submits their file or files of customer data to Datanamix; ustilising our SFTP

- We process and verify the data;

- We return verified data from the relevant Golden Source (such as the Department of Home Affairs) to the business;

- The business integrates the returned data file, refreshing its CRM database;

- And customer records are updated.

Please note: The time it takes from Datanamix to receive the data files, to return the verified data, depends on the size of the batch. As a guide:

- Return time for standard requests (in the thousands): 48 to 72 hours (about 2 to 3 days)

- Return time for medium requests (hundreds of thousands): 72 hours (about 5 days)

- Large requests (in the millions): 7 to 10 working days

Please note: Our batch service is only available to qualifying customers and is not applicable to companies doing checks on behalf of another company.

What does our Batch Verification suite of products include?

Our Batch Verification Service is available across our range of verification and risk management products, including:

- ID Verification

- Bank Account Verification

- CIPC Business Verification

- KYC (Consumer) Verification

- AML Sanction Verification

- Custom Combined FICA batch

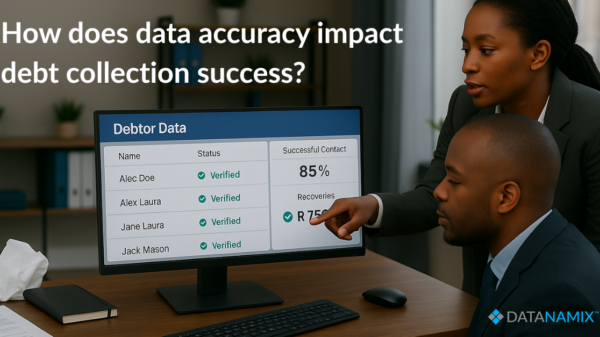

- Debt Collecting

- VAT Verification

How does batch verification benefit you?

Our Batch Verification Service allows responsible organisations to efficiently authenticate customer information within the account management space, where all customers reside. This ensures adherence to the FIC Act without the usual substantial investments of time, finances, and resources. The provided data originates directly from the pertinent Golden Source, ensuring its accuracy and up-to-date nature.

Here are a few benefits batch verification can provide you with;

- Better cost per search on each verification

- Accurate data obtained only from golden sources

- Secure upload of customer information

- Data can be returned in various output formats are available.

- Customisable configurations for batch FICA searches

- Better customer experience

- Enhanced air of professionalism

- Improved brand reputation

What gaps does AI address in the batch verification process?

Batch verification processes often involve intricate manual tasks that consume a significant amount of time and are susceptible to human errors. By leveraging AI, these data-intensive processes can be streamlined, leading to rapid, precise, and efficient data enrichment outcomes. AI’s emphasis on Data Science empowers employees to allocate their attention to other critical tasks.

Glossary of terms used

* FICA: The Financial Intelligence Centre Act – South Africa’s primary anti-money laundering and counter-terrorism financing legislation. FICA aims to ensure that financial institutions know with whom they are doing business. The Act was amended in 2017 to bring South Africa in line with international standards set by the Financial Action Task Force in combating money laundering and the financing of terrorism.

* KYC: Know Your Customer is a business principle that falls within the FIC Act, which urges relevant companies to determine and verify the identity of their customers before they embark on doing business with them. KYC helps prevent people from opening accounts anonymously or under false names.

REFERENCES:

FICA – https://www.gov.za/documents/financial-intelligence-centre-act

Datanamix Batch Verification – https://www.datanamix.com/batch-verification/

Batch Verification Service: Fast, Accurate FICA Compliance – https://bit.ly/3QhiQDK