Our new mobile phone-based API allows businesses to effectively evaluate their fraud risks and enhance the user experience.

pbVerify has added to its risk management suite of API products, giving businesses even more shield against fraud, and the reputational and revenue blow it causes – this time via mobile phone identification and score.

The pbVerify PhoneID & Score API gives businesses detailed and actionable global phone number and subscriber data intelligence, to the end of reinforcing authentications, evaluating fraud risks, and enhancing overall user experience.

This powerful API consists of two parts:

- Phone number identification (PhoneID): Businesses submit a mobile phone number and get data back that helps them answer critical questions about consumers. The API offers data intelligence about a consumer’s device, contact information, and more. Phone number data intelligence can help strengthen the user verification process, reduce fake accounts, inform risk models, improve conversions, and even determine the optimal channel for message delivery.

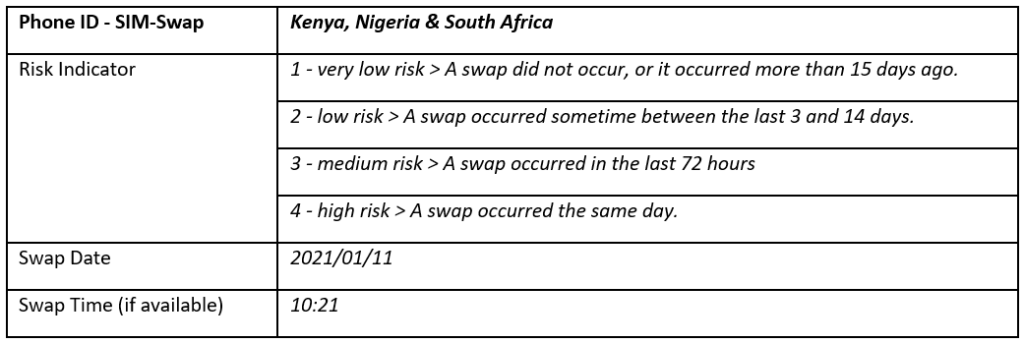

Additionally, PhoneID’s SIM Swap feature allows businesses to find out whether a phone number’s SIM has been swapped and if so, at what point. The API then evaluates the likelihood of the SIM swap having been to commit fraud, using a scale from 1 to 4.

The table below indicates an example of the report information with the different SIM swap risk bands:

Mobile phone number/ID score (Score): By registering fake accounts, criminals can attack legitimate users, thereby damaging your brand’s reputation and revenue. By identifying and blocking fraudsters at account registration, businesses effectively streamline the process for genuine users. The “Score” part of pbVerify’s PhoneID & Score API allows businesses to carry out reputation-based scoring on a consumer’s mobile phone number, helping them to identify bad actors out to use their account for phishing attacks, promo abuse, and other fraud.

PhoneID & Score benefits

- Global data coverage: PhoneID will answer critical questions about users with data available in over 230 countries and territories.

- Stronger authentication & reduction of fraud: PhoneID gives instant API access to ongoing and accurate key phone number and user identity data attributes, allowing businesses to make better decisions about new registrations, user activity and fraud risks.

- Easy integration: PhoneID enables business to be done with absolute confidence. Real-time data on phone numbers and users enables improved conversions, as well as heightened compliance.

- Grow user base responsibly: Phone Score allows businesses to streamline the account registration process and grow their userbase of verified and valuable users securely.

- Identify fake & suspicious users: Phone Score allows businesses to reduce fraudulent activity and validate that end-users are who they say they are.

- Protect brand reputation & value: Phone Score allows businesses to reduce the negative impacts of fraud while creating a more authentic and valuable user base.

For a business, falling victim to fraud is potentially ruinous. pbVerify’s suite of products help businesses stop fraud in its tracks. Forewarned is forearmed.

The PhoneID & Score product is available on the pbVerify platform in a RESTFul API for direct integration only. Please contact our support team for further instruction on starting the customer onboarding process and due diligence process to access this service: Phone: +27 (0)10 823 5194 / Email: [email protected]