What is the global standard for identity proofing?

Identity proofing has become the backbone of secure digital transactions. Whether you’re onboarding a new customer, verifying a remote employee, or managing regulatory compliance, your approach to identity proofing directly impacts trust, speed, and security.

With more businesses moving operations online, the demand for reliable identity proofing has surged, especially in regulated industries like finance, insurance, telecoms, and health.

But with varying requirements across regions, one question keeps coming up: What is the global standard for identity proofing? Understanding the answer can help your organisation adopt a smarter, more future-proof approach to identity proofing that meets compliance requirements and strengthens digital strategy.

Why global identity proofing standard matters

A consistent approach to identity proofing is a critical line of defence against fraud, identity theft, and onboarding risks. In the absence of a global benchmark, many businesses have adopted piecemeal solutions, using basic document uploads, selfie checks, or unverified data sources. This often leads to weak identity proofing frameworks that expose businesses to non-compliance, data breaches, and onboarding failures.

That’s where internationally recognised standards come in. The most widely referenced benchmark is NIST 800-63A from the U.S. National Institute of Standards and Technology. It defines clear, risk-based levels of identity proofing assurance, offering a structured way to validate someone’s identity based on the sensitivity of the transaction. Standards like these are critical for cross-border operations where identity proofing must work seamlessly across jurisdictions.

What does the global identity proofing standard include?

The global standard for identity proofing focuses on a few key pillars: Evidence collection, validation, verification, and fraud detection. These are usually defined within a framework that classifies identity proofing levels by assurance, low, moderate, or high.

Here’s what that looks like:

- Evidence collection: Gathering authentic documents or biometric data from the individual.

- Validation: Checking that these documents or data sources are real and untampered.

- Verification: Confirming that the person presenting them is who they say they are.

- Fraud detection: Using AI and liveness detection to ensure the identity proofing process is not being spoofed or manipulated.

Together, these components help ensure that identity proofing is accurate, repeatable, and compliant with international best practices. It also provides a roadmap for businesses looking to modernise legacy KYC or onboarding processes.

Who sets the global identity proofing standard?

Several authorities play a role in shaping the global landscape for identity proofing. While there isn’t one single body that governs it worldwide, the most influential frameworks include:

- NIST 800-63A (USA): Sets identity assurance levels (IAL1–IAL3) for digital identity systems.

- eIDAS Regulation (EU): Defines electronic identification and trust standards across Europe.

- ISO/IEC 29003: An international standard for identity proofing and enrolment processes.

- FIDO Alliance & Kantara Initiative: Industry groups focused on strengthening digital identity ecosystems.

By aligning with these standards, businesses can build identity proofing systems that are globally accepted, interoperable, and scalable. It also makes compliance audits easier, especially in industries where regulatory bodies expect strong identity controls.

Identity proofing vs identity verification: what’s the difference?

Although the terms are often used interchangeably, there’s a key difference between identity proofing and identity verification.

Identity proofing refers to the entire process of collecting, validating, and verifying evidence to establish a person’s identity at the start of a relationship, typically during onboarding.

Identity verification, on the other hand, usually refers to checking an already-established identity at a later stage (for example, during login or a high-risk transaction).

Understanding this distinction is vital. Businesses that conflate the two may underinvest in the initial identity proofing stage, leaving themselves vulnerable to fraud or failed KYC. Strong identity proofing lays the foundation for all downstream verification processes to succeed securely.

What technologies support modern identity proofing?

Today’s global identity proofing standard is technology-driven. Gone are the days of manual document checks and physical branch visits. Leading organisations now use a blend of advanced tools, including:

- Biometric face matching (2D and 3D)

- Liveness detection and spoof resistance

- Trusted data sources and government registries

- Machine learning for anomaly detection

These tools make identity proofing more accurate, scalable, and fraud-resistant, especially when combined with orchestration platforms that can adapt to different risk levels. Most importantly, they ensure that users can prove who they are in seconds, not hours.

What should businesses look for in an identity proofing solution?

If your organisation is exploring new tools or platforms for identity proofing, it’s important to assess them against key criteria:

- Standards compliance: Does the solution align with NIST, ISO, or eIDAS benchmarks?

- Fraud resistance: Can it detect spoofing, deepfakes, or synthetic IDs?

- Coverage: Can it verify both local and international users?

- Speed and UX: Is the process fast and user-friendly?

- Auditability: Can you easily demonstrate identity proofing assurance during a compliance audit?

The right solution should strike a balance between user experience and security, offering frictionless journeys without sacrificing trust.

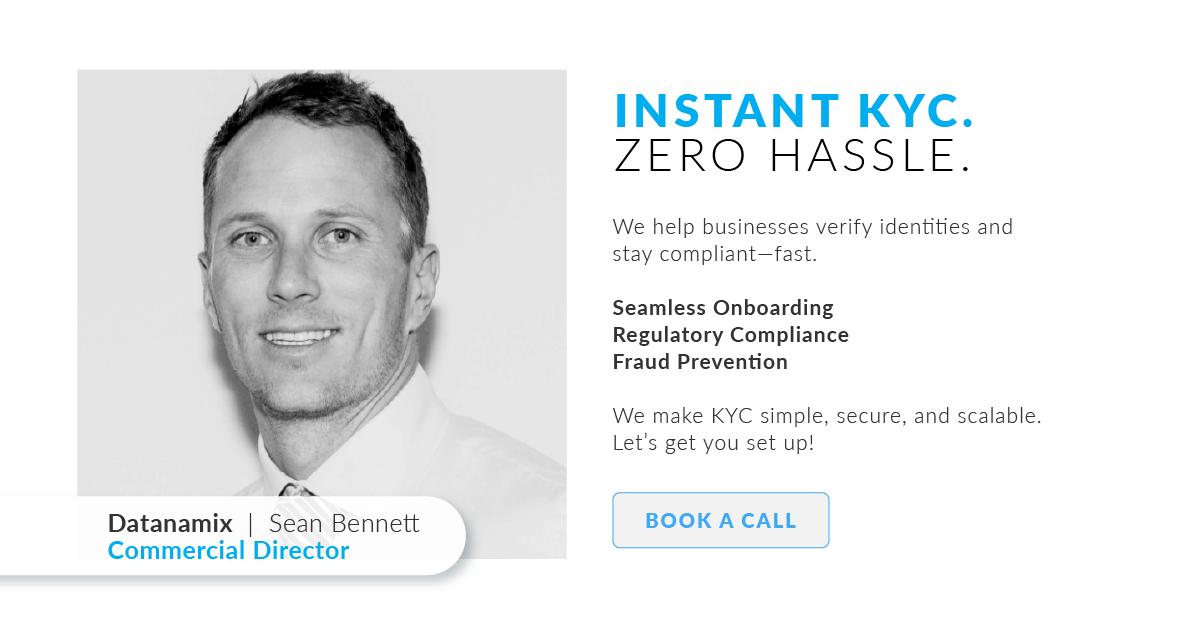

Datanamix: Identity proofing built for trust

At Datanamix, we believe strong identity proofing shouldn’t come at the cost of your customer’s time or your compliance budget. Our platform integrates with industry-leading biometric and data verification partners to deliver accurate, real-time identity proofing without the operational drag.

Whether you’re replacing legacy ID checks or scaling digital onboarding across borders, we help you align with the global standard for identity proofing, securely, simply, and smartly.