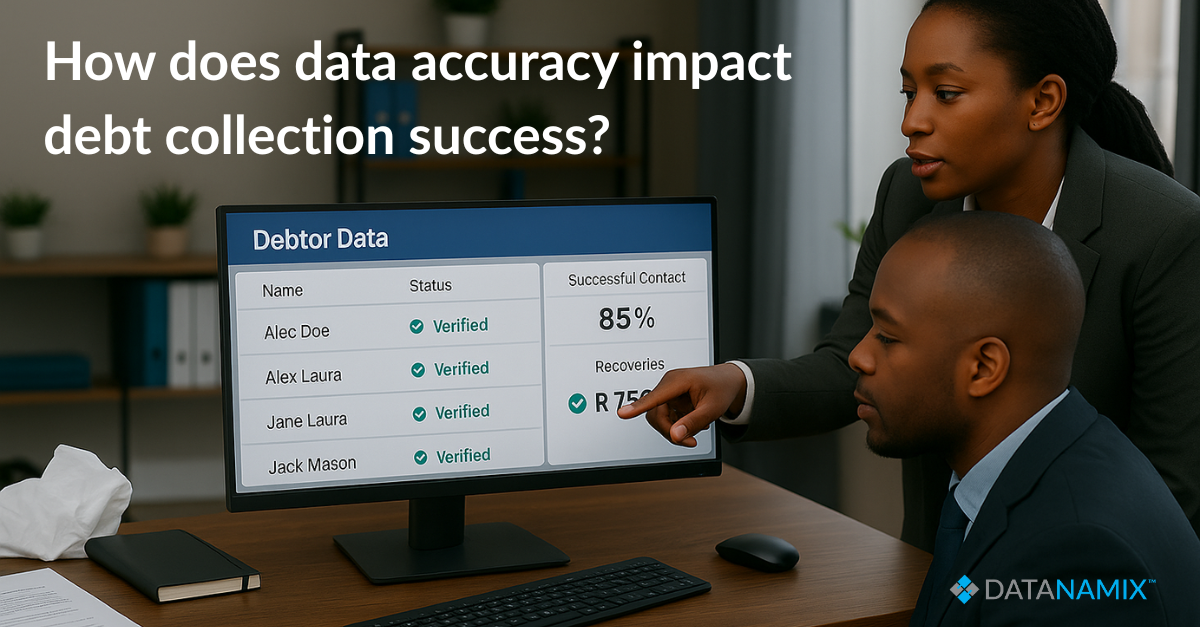

In South Africa’s highly regulated financial landscape, data accuracy can make or break your debt collection strategy. Whether you’re chasing early reminders or pursuing late-stage recoveries, accurate debtor data is the engine driving success. But what happens when that data is flawed? Suddenly, calls go unanswered, letters bounce, and legal handovers fall apart. Data accuracy affects every stage of debt collection, from verification and tracing to compliance checks and final settlements.

If you’re still manually cleaning lists or second-guessing contact info, you already know the pain. For modern debt collection professionals, data accuracy is more than just a metric. It’s a mission-critical advantage. With rising POPIA pressures and public scrutiny, debt collection firms must rethink their approach. And it all starts with data accuracy.

Why is data accuracy so important in debt collection?

At its core, debt collection depends on reaching the right person at the right time with the right information. But when your contact lists are riddled with errors, you’re not just losing time. You’re losing trust. Data accuracy ensures your communications land, your legal notices stick, and your recovery strategy doesn’t unravel.

In South Africa, where POPIA compliance is non-negotiable, using incorrect or outdated information during debt collection can lead to legal action and brand damage. With data accuracy, teams minimise return mail, increase successful contacts, and protect the business from costly missteps.

How does poor data accuracy increase compliance risk in debt collection?

Compliance isn’t a checkbox. It’s your safety net. In debt collection, especially under POPIA and the National Credit Act, using inaccurate debtor data can expose you to fines, litigation, and operational shutdowns. From storing the wrong contact number to incorrectly sharing debtor information with third parties, the risks multiply fast.

Data accuracy allows you to safeguard personal information, verify debtor identities, and ensure communications align with consent records. For compliance officers and debt collection leaders alike, investing in data accuracy is a direct investment in legal protection.

What happens when your debt collection strategy relies on bad data?

Picture this: Your recovery team runs a high-volume campaign using a list pulled from an old CRM. Half the phone numbers are outdated, addresses are stale, and email bounces are climbing. Suddenly, performance drops, agents lose morale and your promise-to-pay ratio plummets.

This isn’t just inefficiency. It’s an operational risk. Without data accuracy, your debt collection engine sputters. And manual list cleanup isn’t just slow. It’s unsustainable. To scale successfully, collection teams must move away from static databases and embrace tools that deliver dynamic, verified, and trace-ready data in real-time.

Why contact rates suffer when data accuracy is ignored

Low contact rates are more than an annoyance. They’re a signal that your debt collection machine needs an overhaul. When agents spend their days chasing unreachable numbers or sending mail to outdated addresses, costs rise, and results fall.

Data accuracy improves reach by confirming that the right person is being contacted through the right channel. From mobile verification to real-time risk flags, data accuracy is the key to higher response rates, better debtor engagement, and smoother debt collection workflows. If you’re tired of “number not in service” replies, it’s time to trust your data again.

How to clean data boosts early and late-stage debt collection

Debt collection isn’t a one-size-fits-all game. Early-stage reminders require speed, while late-stage recoveries demand legal precision. Data accuracy empowers teams to adapt across both. In the early stages, clean debtor data enables automated SMS and email campaigns that reach people fast and respectfully.

In late-stage scenarios, validated addresses, employer information, and ID checks support pre-litigation profiling and smooth legal handovers. Debt collection teams that rely on up-to-date, accurate records see higher right-party contact rates and faster resolutions. Whether you’re nudging or escalating, data accuracy ensures every action hits its mark.

What are the real-world costs of inaccurate data in debt collection?

Let’s talk numbers. A single bad data point, like a misspelt email or an outdated surname, can multiply into hours of wasted effort. Multiply that across hundreds or thousands of accounts, and suddenly, your debt collection strategy becomes a bottleneck.

Missed contacts mean missed payments. Incorrect details result in failed legal actions. Data accuracy reduces rework, minimises disputes, and shortens turnaround times. For businesses managing third-party or internal debt collection, this translates directly into saved money, improved recovery rates, and stronger reputational standing.

What tools can improve data accuracy in debt collection?

Manual data cleaning is not only outdated, it’s costing you recoveries. Datanamix’s debt collection solutions replace unreliable spreadsheets with real-time debtor verification, enriched contact data, mobile trace readiness, and automated risk scoring. Our products deliver trace-ready, compliant information from day one. Ensuring every collection effort is backed by accurate, POPIA- and NCA-aligned data.

Whether you’re managing early reminders or final handovers, Datanamix keeps your collections data accurate, current, and actionable. If you’re still relying on legacy systems, it’s time to switch to intelligent recovery solutions that actually work.

How does data accuracy reduce reputational risk for debt collectors?

Inaccurate data doesn’t just slow down your recovery. It damages your brand. One wrong letter sent to the wrong person can go viral in the worst way. In South Africa’s tight regulatory climate, debt collection professionals must tread carefully.

Data accuracy protects against mistaken identity, harassment claims, and misinformation disputes. It also shows that your organisation takes privacy and professionalism seriously. From a reputational lens, debt collection success is about more than collections. It’s about how you collect. And that starts with accurate, verified, and ethical data use.

Why debt collectors need a data accuracy strategy, not just a cleanup

It’s not enough to clean data once. Without a sustainable approach, your contact database starts decaying the minute you stop maintaining it. That’s why smart debt collection teams don’t wait for errors. They prevent them. A real data accuracy strategy involves automated syncing with trusted data sources, proactive alerts for inconsistencies, and regular audits.

This is especially vital for compliance teams and recovery managers looking to reduce POPIA exposure and maximise results. A once-off cleanup might give a temporary boost, but long-term debt collection success depends on continuous, real-time data quality control.

What does the future of debt collection look like with accurate data?

It’s agile. It’s automated. And it’s fully compliant. The future of debt collection in South Africa lies in systems that combine machine learning, behavioural insights, and data accuracy to optimise every debtor interaction. With AI-driven profiling, pre-emptive risk scoring, and verified contact channels, collectors can focus more on resolving debts and less on chasing ghosts.

For those managing compliance, POPIA reporting, and executive dashboards, accurate data offers the clarity and confidence needed to scale. With data accuracy at its core, the next generation of debt collection is proactive, precise, and people-friendly.

Final thought: How to lead your debt collection team into a data-accurate future

South African debt collection professionals face a complex road, balancing compliance, performance, and empathy. But with data accuracy as your foundation, that road becomes clearer. No more shooting in the dark. No more costly compliance slip-ups. And no more wasted calls to dead numbers. By prioritising verified, up-to-date data, your team gains confidence, your processes become smoother, and your recovery rates climb.

That’s where Datanamix comes in. From clean data imports to real-time debtor insights, Datanamix helps debt collection professionals automate the grunt work and focus on what really matters: Getting results the right way. With a partner that puts data accuracy first, you don’t just recover debt. You recover time, trust, compliance, and peace of mind.

Need to see it in action?

Explore how Datanamix powers efficient, compliant, and data-driven debt collection workflows.