It is vital to prioritise due diligence when considering that any delay in the process may result in overlooking important signals and red flags that could otherwise be identified. In a world where information travels at lightning speed, potential risks can escalate quickly.

Being caught off-guard can be detrimental, whether it’s a cybersecurity threat, regulatory change, or shifts in market dynamics. Delayed due diligence can not only have financial implications but also erode stakeholder trust and damage a company’s brand. As a result, organisations need to prioritise ongoing due diligence efforts.

Here are some key strategies for adopting a proactive approach:

1. Continuous Monitoring:

Organisations can receive real-time updates on various aspects of their business environment by implementing continuous monitoring systems. These updates can include changes in regulations, market trends, and potential threats.

By staying informed, organisations can adjust their strategies quickly and mitigate risks before they escalate. Datamatix’s AML Sanction Screening services and our comprehensive Credit Checking and KYC Infinite solution will help with your annual risk assessment of any customer.

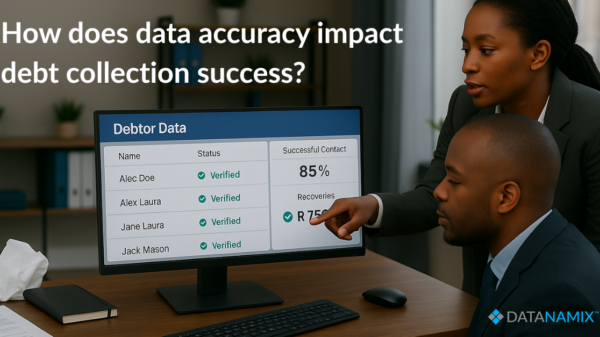

2. Data-driven Decision Making:

Leveraging data analytics and artificial intelligence to analyse vast amounts of information quickly enables organisations to identify patterns, anomalies, and potential risks that may not be evident through traditional due diligence methods.

Data-driven decision-making empowers businesses to make informed choices in a timely manner. With Datanamix KYC Infinite solution, whether API or Batch, you can build robust data-driven compliance processes with automated review and decision-making.

3. Collaborative Due Diligence:

Engaging in collaborative due diligence efforts with stakeholders, industry partners, and experts fosters a culture of shared responsibility. By doing so, organisations can tap into collective intelligence that enhances their ability to identify and address risks collaboratively.

4. Scenario Planning:

Developing and regularly updating scenario plans enables organisations to anticipate potential risks. By simulating different risk scenarios, businesses can better understand their vulnerabilities and implement proactive measures to safeguard against them.

Why is sanctions compliance important, and where does Datanamix come in?

To prevent financial loss and reputational damage, businesses must carry out due diligence processes. Datanamix offers a suite of AML Sanction Screening products that are customisable to suit the specific needs of any business, from accountable institutions to SMEs. The suite includes DPEP / FPEP data, Adverse Media and Crime Data.

Datanamix assists businesses in mitigating the risk by onboarding consumers who might not be eligible. Datanamix Premium AML Sanction Screening is an online search tool that helps you screen prospective clients and perform enhanced due diligence.

Our premium AML solution accesses all lists available worldwide in the way of PEP, Sanctions & Adverse media data. It allows you to detect individuals, organisations, and vessels linked to more than 50 risk categories, including sanctions, foreign officials, and state-owned enterprises.

Datanamix provides conclusive decisioning on its premium AML service (Matched, Reviewed & not matched).

In a world where risk is omnipresent, due diligence cannot be confined to a specific date on the calendar. Organisations need to adopt a proactive and continuous approach to due diligence to navigate the complexities of the modern business landscape successfully.

By embracing real-time monitoring, data-driven decision-making, collaboration, and scenario planning, businesses can fortify themselves against the uncertainties that lie ahead. After all, in the realm of due diligence, the only schedule worth adhering to is the one that keeps risk at bay.