When it comes to preventing digital fraud, many businesses are still using tools built for a different era. Passwords, photos, OTPs, they’re easy to bypass. And as scams evolve, bad actors are no longer only trying to steal data; they’re stealing identities.

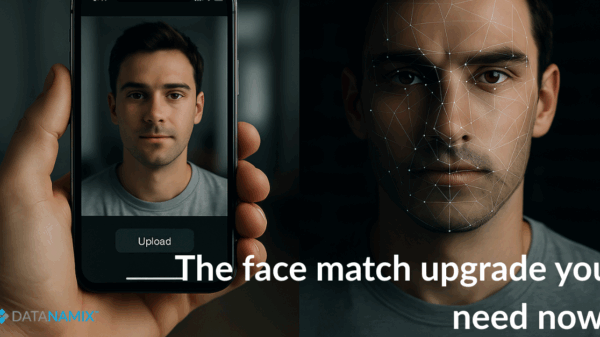

That’s why 3D face matching has become the new gold standard. It doesn’t just ask for an image, it demands proof of presence. While digital fraud continues to scale globally, many organisations are waking up to the power of real-time biometrics. And where traditional verification falls short, 3D face matching gives businesses the confidence to verify people, not just documents.

It’s becoming a vital shield against impersonation, identity theft, and deepfake-driven digital fraud, especially in sectors where trust is everything. As fraudsters become more sophisticated, 3D face matching offers something they can’t fake: a living, breathing human behind the camera.

While digital fraud continues to scale globally, many organisations are waking up to the power of real-time biometrics, such as 3D face matching.

Why 3D face matching beats traditional tools in digital fraud detection

Most verification tools check the surface, a name, a document number, a selfie. But digital fraud is no longer superficial. Fraudsters reuse ID photos, launch deepfake attacks, and manipulate static images. This is where 3D face matching excels. It goes beyond the flat, two-dimensional checks that scammers know how to beat. Using advanced liveness detection, this technology ensures the person being verified is physically present and not a spoof.

At this point, you might be wondering if 3D face matching is overkill for your sector. It’s not. If your business operates in (amongst others) :

- finance

- insurance

- gambling

- gig platforms, or

- dating apps

you are a prime target for digital fraud. And if you’re still relying on outdated verification processes, you may already be letting fraudsters through the door.

How Datanamix uses 3D face matching to stop digital fraud

Here’s where Datanamix makes a difference. We’ve integrated Facetec, one of the world’s leading 3D biometric providers, into our data bureau stack. This means our clients get smart ID verification plus fraud prevention engine that uses 3D face matching to vet every onboarding attempt in real time.

While other systems depend on Department of Home Affairs (DHA) records, Datanamix takes things a step further. Our solution extracts a photo from a government-issued ID, then compares it to a real-time 3D scan of the user’s face. No static selfies. No spoofing. No replays of old videos. Just live identity verification that neutralises digital fraud before it begins.

By combining facial biometrics with our Profile ID and Profile Plus data blocks, we give clients layered protection. So even if someone tries to game one part of the system, 3D face matching shuts them down at the point of entry. This kind of layered defence is critical in preventing large-scale digital fraud campaigns, especially in high-risk sectors.

Where 3D face matching is changing the game in digital fraud prevention

The rise of digital fraud isn’t just affecting banks. It’s hitting logistics firms, ride-hailing apps, gambling platforms, and even dating services. Anywhere a real person is meant to be behind a profile, fraudsters are trying to sneak through. And that’s exactly where 3D face matching makes an impact.

In fintech and banking, it’s used to verify customers during digital KYC. It ensures loan applicants are real, not ghost identities. In insurance, it prevents policy fraud by linking a living claimant to a valid ID. Gambling platforms use it to verify age and stop underage access. Dating apps rely on it to verify authenticity and user safety. And gig platforms apply it to prevent identity swapping, where one person signs up but someone else does the work.

All of these sectors are facing high volumes and high risk. With 3D face matching, they can scale safely and reduce the cost of digital fraud across the board.

Why 3D face matching is ideal for foreign nationals and digital onboarding

One of the toughest challenges in fighting digital fraud is verifying foreign nationals. DHA checks are often unavailable, and many global users fall outside local verification systems. That’s where 3D face matching shines.

Unlike traditional methods that rely on national databases, 3D face matching works purely by comparing an ID photo with the user’s live scan, regardless of nationality. It’s currently active in over 500 countries, making it ideal for platforms with a global user base.

For digital lenders, crypto exchanges, and gig platforms that work with foreign contractors, this means no more delays, no more excuses, and far fewer fraud attempts. Users don’t need to go to a branch, and your team doesn’t need to manually verify documents. 3D face matching automates the process while protecting against digital fraud, even when local ID systems fall short.

How 3D face matching protects both people and platforms from digital fraud

We tend to think of digital fraud as a financial issue, but it’s not just about money. Identity fraud allows criminals to open bank accounts, commit scams, and impersonate others online. In dating apps, it leads to catfishing and real-world abuse. In gig platforms, it can allow banned users to return under new aliases. In all these cases, the victim isn’t just a business. It’s a person.

That’s why 3D face matching is a barrier between vulnerable people and those who would exploit them. And it works quietly in the background, delivering a smooth user experience while stopping digital fraud with precision and speed.

With liveness detection and anti-spoofing built in, 3D face matching ensures that only real people can pass through your onboarding funnel. That reduces fraud, protects reputations, and builds trust with every interaction.

The future of IDV is 3D face matching, not paper-based checks

As more organisations go digital, the weaknesses in traditional ID verification are becoming clear. Static images, document uploads, and database checks can’t stop deepfakes, bots, or photo reuse schemes — especially with AI now making it easier for fraudsters to generate realistic fakes at scale. To beat modern digital fraud, businesses need modern tools. And that means 3D face matching.

3D face matching is more secure, faster, privacy-friendly, and easy to integrate. With cloud-based APIs and mobile-first UX, 3D face matching fits naturally into your existing onboarding flow. And because it doesn’t rely on any one government system, it gives you resilience, even when DHA isn’t available.

In the near future, we’ll see more regulatory pressure to incorporate biometrics. By adopting 3D face matching now, you stay ahead of the curve and stay protected against a growing wave of digital fraud.

Conclusion: 3D face matching is the digital fraud deterrent businesses need now

From impersonation to deepfakes, digital fraud is becoming more advanced and more damaging. Businesses need more than just data lookups or scanned IDs. They need a way to confirm that there’s a real human behind the screen. That’s exactly what 3D face matching delivers.

Whether you’re operating in fintech, insurance, logistics, or social platforms, now is the time to rethink your verification stack. And if DHA checks aren’t enough, Datanamix is ready to help you level up.

With Facetec’s proven biometrics built into our platform, you can:

- Verify users in seconds

- Prevent fraud before it starts

- Onboard foreign nationals with ease

- Stay compliant without adding friction

- Protect both your business and your customers

Businesses need more than just data lookups or scanned IDs. They need a way to confirm that there’s a real human behind the screen. That’s exactly what 3D face matching delivers.

Ready to upgrade your fraud protection with 3D face matching?

Book a demo with Datanamix and see how easy it is to deploy.