SMEs in South Africa often face massive roadblocks when it comes to growth. Not because their services aren’t great, but because the behind-the-scenes admin slows everything down. From onboarding delays to manual processes that are ripe for errors, Small and medium-sized enterprises (SMEs) are stuck juggling compliance risks, staff shortages, and outdated methods. And nowhere is this more obvious than in how SMEs handle credit checks for credit vetting.

The credit vetting process is often slow, manual, and inconsistent, which can jeopardise a deal before it even starts. If SMEs want to succeed, automated credit checks are the way forward. And the best part? Today’s tech allows SMEs to automate credit checks for credit vetting without draining their time, budget, or sanity.

Why SMEs need to move past manual credit checks

Growing SMEs can’t afford delays, yet many still depend on spreadsheets and paperwork to vet new clients. It’s slow, error-prone, and risky. SMEs handling credit checks manually face frequent errors, overlooked risk flags, and massive administrative burdens. In fast-paced markets, that’s a recipe for disaster.

Automated credit vetting can address this challenge, but it is essential to select a solution that not only digitises the existing process but also transforms it. Small and medium-sized enterprises (SMEs)that implement automated credit checks effectively can gain immediate insights, simplify compliance, and accelerate onboarding while safeguarding their cash flow and reputation.

The cost of slow onboarding and compliance chaos for SMEs

Let’s say an SME owner finally lands a dream client. The deal’s ready to go, but there’s a hiccup: the credit check process takes five days. During that time, the client finds another supplier. This is a painful reality for many SMEs. Automated credit checks don’t just make things faster; They prevent missed opportunities.

Beyond that, compliance is a lurking threat. SMEs are still liable under FICA regulations, even if they don’t have the resources of big corporates. Manual checks are inconsistent, leave gaps in audit trails, and expose SMEs to potential penalties. By switching to automated credit checks, SMEs can instantly verify customer info, flag risky profiles, and prove compliance, all without lifting a finger.

How automated credit checks reduce bad debt for SMEs

One of the biggest fears among SME owners is taking on a client who looks good on paper but turns out to be a non-payer. It only takes one bad debtor to derail cash flow. With automated credit checks, SMEs can access real-time data to assess risk before any invoices go out. No more guessing based on gut feel or outdated reports.

These systems provide instant profiling by checking credit history, confirming registration information, and verifying contact details. The result? SMEs make better calls on who to do business with and avoid slow-paying or high-risk clients that put their financial stability at risk.

What should SMEs look for in a credit check solution?

Not all automated credit check tools are created equal. SMEs need a full onboarding intelligence.

That means:

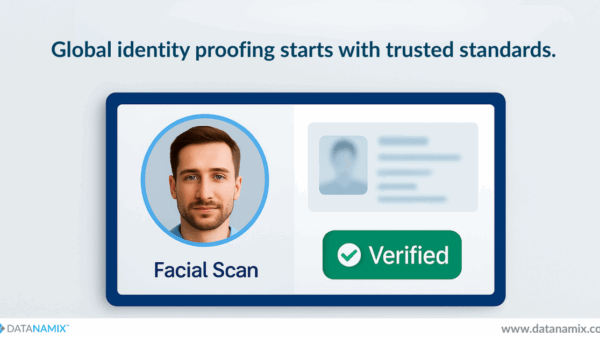

- Instant access to registration and identity data

- Integration with FICA/KYC compliance requirements

- Clear credit scores and risk indicators

- Smart workflows that remove manual steps

- APIs or dashboards that fit into existing systems

For SMEs, automated credit checks must be easy to use, cost-effective, and deliver results fast. Anything less is just replacing one slow process with another.

Why automation helps SMEs grow faster and smarter

Here’s the truth: SMEs want to save time, but more than that, hey want to scale. But scaling without the right vetting process in place is risky. That’s where automated credit checks come in. When you remove friction from onboarding, SMEs can say “yes” to more good customers without putting the business at risk.

Automation fuels growth. SMEs can make faster decisions, approve more applications, and move from lead to invoice in days, not weeks. That kind of agility is what separates thriving businesses from those stuck in the survival lane.

Introducing Datanamix: Built for SMEs that want smart credit checks

This is where Datanamix changes the game. We’ve built our solutions specifically with South African SMEs in mind. Our automated credit check platform combines advanced data sources, intuitive dashboards, and compliance-ready workflows all in one place.

Whether you’re onboarding a new customer, verifying a supplier, or screening a partner, Datanamix gives SMEs real-time access to:

- Company registration data from multiple sources

- Traceable identity verification

- Consumer and business credit scores

- Built-in FICA and POPIA compliance support

- Smart decision tools that flag potential issues before they become problems

With Datanamix, SMEs can automate credit checks and streamline every part of their onboarding process without needing a massive IT team or legal department.

Built-in compliance without the legal headache for SMEs

We get it — FICA and POPIA are intimidating. For SMEs, automated credit checks must also tick the legal boxes. Datanamix does this out of the box. Our tools are designed with compliance baked in, so you don’t have to stress about audit trails, document retention, or privacy flags.

Each time SMEs use our platform for credit checks, they’re also capturing the records needed to show compliance. That’s peace of mind on top of speed and accuracy.

Faster onboarding means fewer lost deals for SMEs

You don’t get a second chance to impress a new client. SMEs who automate credit checks can cut onboarding times drastically, from days to minutes. That makes your team look professional, responsive, and trustworthy.

Using Datanamix, SMEs can set up fully automated onboarding journeys that include credit checks, ID verification, and document uploads in a single flow. No back-and-forth. No delays. Just clean, fast, efficient onboarding that keeps deals moving forward.

Scalable solutions that grow with your SME

What works for five clients won’t work for 500. Datanamix grows with you. Our automated credit check platform is scalable and designed to serve lean startups and expanding SMEs alike. Whether you’re checking one application a day or one hundred, our systems adapt to your needs.

For SMEs, this means one platform that handles growth without adding complexity. You won’t outgrow us; We grow with you.

One platform. Multiple data checks. Total peace of mind for SMEs

Running credit checks manually often means bouncing between multiple platforms, PDFs, and Google tabs. With Datanamix, SMEs get all the insights in one dashboard. We pull data from multiple trusted sources, merge it into an intuitive report, and give you decision-making power instantly.

Whether you’re checking a director’s ID, confirming a business address, or evaluating a credit profile, it’s all right there. That’s the power of automated credit checks, delivered your way.

Empower your team. Protect your cashflow. Grow your SME.

Automated credit checks empower your team to move fast, protect your SME from bad debt, and win over more customers. And with Datanamix, it’s not just automation; It’s intelligent, compliant, and purpose-built for South African SMEs.

No more onboarding delays. No more compliance stress. No more guesswork. Just accurate data, streamlined decisions, and faster growth. That’s what SMEs deserve, and that’s what we deliver.

Ready to automate credit checks the smart way?

Let Datanamix help your SME verify faster, onboard better, and grow with confidence.

Contact us now to get started.