Proactively planning for your KYC review for 2025 is a strategic move that ensures your company is well-prepared to meet regulatory standards. This proactive approach can make you feel more in control and ready for any regulatory changes. Focusing on a comprehensive KYC review protects your business from potential risks and safeguards your reputation.

A well-executed KYC review limits exposure to financial crimes and keeps your operations compliant with evolving global standards. Companies that plan for their KYC review can more effectively mitigate risks, enhance customer trust, and maintain operational efficiency. With the right solutions, your KYC review can become a streamlined process that supports business growth.

Why should you plan for your KYC review?

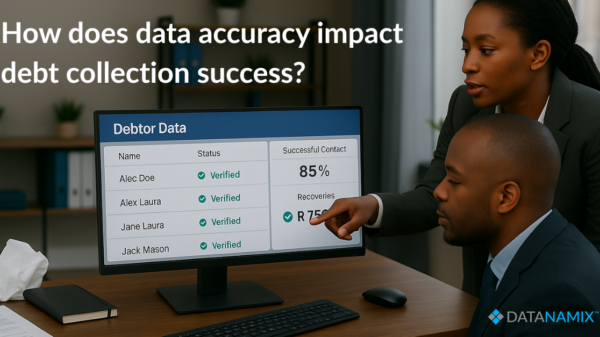

Planning for your KYC review for 2025 is critical to ensuring your company is fully prepared to meet regulatory standards and maintain compliance. A thorough KYC review protects your business from potential risks, such as financial crimes and fraud, and helps preserve your reputation in the industry. Proper planning ensures you can identify and mitigate risks, address regulatory requirements efficiently, and safeguard your business against penalties. Businesses that plan for their KYC review also enjoy smoother operations and enhanced customer trust, creating a solid foundation for growth and success in a highly regulated environment.

How can you plan for your KYC review?

Planning for your KYC review for 2025 is critical to ensuring your company is fully prepared to meet regulatory standards and maintain compliance. A thorough KYC review protects your business from potential risks, such as financial crimes and fraud, and helps preserve your reputation in the industry. Proper planning ensures you can identify and mitigate risks, address regulatory requirements efficiently, and safeguard your business against penalties. Businesses that plan for their KYC review also enjoy smoother operations and enhanced customer trust, creating a solid foundation for growth and success in a highly regulated environment.

Where does Datanamix come in for your KYC review?

Datanamix offers KYC Infinite, a powerful solution that simplifies the KYC review process for businesses. With batch processing capabilities, KYC Infinite automates critical tasks such as identity verification, address validation, and AML compliance, making it easier for companies to prepare for their 2025 KYC review. By utilising KYC Infinite, businesses can streamline their operations, reduce manual errors, and ensure a thorough and efficient KYC review. Whether you’re looking to prevent fraud, meet compliance standards, or strengthen your AML framework, Datanamix’s KYC Infinite equips you with the tools necessary to excel in your KYC preparation and protect your business from regulatory risks.

In conclusion, planning ahead for your KYC review in 2025 is not just about meeting regulatory requirements — it’s about positioning your business for long-term success. By taking a proactive approach and leveraging advanced solutions like Datanamix’s KYC Infinite, you can ensure compliance, enhance operational efficiency, and reduce the risks associated with financial crimes. With thorough preparation and the right tools, your KYC review can become a streamlined, strategic process that supports your business’s growth and stability in an ever-evolving regulatory landscape.