Empower your business with powerful customer management solutions, from staying on top of FICA (Financial Intelligence Centre Act) requirements to building ongoing trust with your customers. By leveraging advanced solutions for customer management, you can meet regulatory requirements and improve your overall customer experience.

Let’s explore some essential customer management solutions that can help you build lasting trust with your customers while mitigating risks.

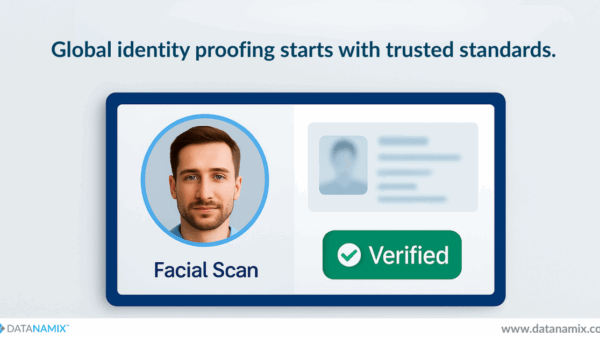

1. Identity Management

Verifying the identity of your customers is the foundation of compliance and risk mitigation. Utilising advanced ID verification solutions ensures you can accurately authenticate customer identities, ensuring they are who they claim to be.

2. PhoneID

In today’s digital age, verifying customers’ phone numbers is crucial. Our PhoneID solution offers real-time verification of phone numbers, helping to reduce fraud and ensure that customer communication channels remain secure.

3. Bank Verification

Validating customers’ bank account information is vital for various financial transactions. Bank account verification solutions enable you to authenticate a customer’s bank account holder details for debit order verification, regulatory requirements and prevent payment fraud. This assists in reducing the risk of fraudulent activities such as money laundering or unauthorised transactions.

4. Affordability Assessment

Customers’ affordability is essential, especially in industries like financial services, lending or insurance. Affordability assessment solutions help you evaluate customers’ financial capabilities, ensuring that the products or services suit their financial situation.

5. Batch Analysis

Processing large volumes of customer data can be challenging without the right tools. Batch analysis solutions enable you to analyse large datasets efficiently, helping you identify patterns, trends, insights and potential risks across your customer base and in the same process, perform customer KYC and due diligence to comply with the regulator. Our batch platform allows you to process millions of records across many different data assets simultaneously.

6. Credit Reports

Accessing credit reports provides valuable insights into customers’ creditworthiness and financial history. Integrating credit report solutions into customer management processes allows you to make informed decisions when offering credit or financial products, reducing the risk of defaults and economic losses.

7. Deeds Search

Conducting deeds searches is crucial for due diligence and compliance in the real estate or property management industries. Deeds search solutions provide access to property ownership records, enabling you to verify property ownership and assess potential transaction risks.

8. Know Your Customer (KYC)

KYC (Know Your Customer) is essential to customer management and crucial to complying with FIC (Financial Intelligence Center) regulations.

KYC ensures that your business is equipped to identify and verify your customers’ identities, assess their risk levels, and monitor their financial activities to prevent money laundering and terrorism financing.

Considering all these factors, customer management is not only a mandatory regulation, but it also provides a strategic advantage for a variety of sectors. By leveraging advanced solutions such as ID verification, phoneID, bank account verification, affordability assessment, batch analysis, credit reports, and deeds search, you can confidently navigate the regulatory landscape, mitigate risks, and build lasting trust with your customers.