The concept of identity has become a crucial asset in today’s digital world, extending beyond just an individual’s name or identity number. It is particularly important when onboarding a customer or in credit management, where businesses need to navigate a complex customer life cycle. Effective identity management solutions are crucial to ensuring potential fraud and compliance risks.

At every stage of the customer life cycle, seamless integration of identity management solutions is critical.

Let’s take a closer look the power of identity management in the customer life cycle:

1. Customer Acquisition

The first step is identifying and attracting potential clients. Robust identity management systems allow for accurate verification of customer identities, streamlining the onboarding process, and reducing fraudulent applications.

Biometric or multi-factor authentication can establish trust from the outset, creating a solid foundation for the business-customer relationship. Doing this first step right is crucial to having a successful and secure customer onboarding process, especially if it is done online remotely.

2. Application Processing

Efficient application processing is essential once customers express interest in obtaining credit. Identity management solutions facilitate the swift validation of applicant information, ensuring compliance with regulatory requirements, and speeding up decision-making.

By automating document verification and identity authentication, businesses can reduce manual errors, improve operational efficiency, and enhance customer experiences.

3. Risk Assessment

Risk assessment is critical in determining the creditworthiness of applicants. Identity management solutions provide valuable insights by analysing vast datasets to assess applicant identities’ legitimacy and detect potential red flags indicative of fraud or identity theft. Advanced analytics and machine learning algorithms allow businesses to make informed decisions based on actionable intelligence.

4. Account Management

Effective identity management extends beyond the initial approval phase, encompassing ongoing account management and monitoring. By continuously validating customer identities and detecting suspicious activities in real-time, businesses can proactively safeguard against identity-related risks, such as account takeovers or unauthorised transactions. Identity management solutions empower organisations to implement robust authentication protocols and access controls, preserving customer trust and loyalty.

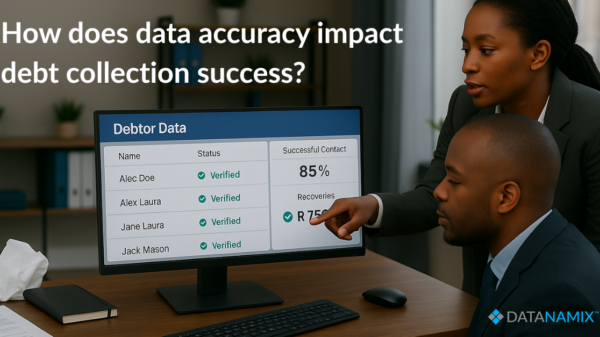

5. Collections and Recovery

Collections and recovery efforts come into play when customers default on credit obligations. Identity management solutions play a pivotal role in facilitating debt recovery by enabling accurate identification of delinquent account holders and tracing their financial footprints across disparate channels.

By leveraging data analytics and predictive modelling, businesses can optimise collection strategies and minimise losses, maximising recovery rates while mitigating operational costs. If the identity process at the beginning of the customer lifecycle is not robust, then the collection process and the end of the cycle will be near to impossible.

Effective identity management is at the heart of the customer life cycle, serving as a linchpin for seamless operations, enhanced risk management, and superior customer experiences. Innovative identity management solutions and technologies can help businesses navigate the complexities of the credit landscape with confidence, unlocking new opportunities for growth and differentiation in an increasingly competitive marketplace.

In conclusion, at Datanamix, we understand the paramount importance of identity management in driving success across the customer life cycle. Our cutting-edge solutions and industry-specific expertise empower businesses to harness the full potential of identity data, enabling them to thrive in an ever-evolving digital ecosystem. Join us on the journey to unlock new possibilities and redefine the future of credit management with Datanamix.