With South Africa’s grey-listed status, financial services must have processes to comply with FICA. Datanamix offers products such as Know Your Customer (KYC) and Anti-Money Laundering (AML) tactics that can assist your brand in complying with the law. Not only that but by having these processes in place, the financial space will be able to accurately identify and assess the risks associated with their customers, preventing illicit activities such as money laundering and fraud.

Although these tactics can assist in identifying high-risk customers, it all comes down to the quality of data — especially when it comes to big data. This is where Artificial Intelligence (AI) plays a huge role.

So much data is out there that it often needs to be more organised. The integration of AI can revolutionise data quality and enhance the efficiency of KYC and AML verifications.

Ready to dive deep into the world of AI? Let’s do it:

So, what is the challenge with obtaining quality data?

One of the biggest challenges in KYC and AML verifications is dealing with vast amounts of unstructured and inconsistent data. Customer information can come from multiple sources in various formats and spread across the business in different silos, making it difficult to ensure accuracy and completeness.

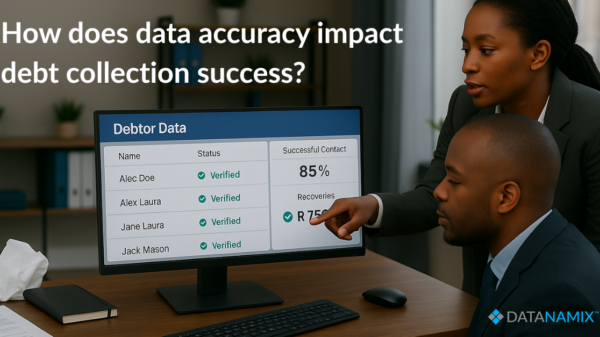

Traditional manual data verification processes are not only time-consuming, but they are also prone to human errors. This can lead to severe consequences regarding regulatory compliance and financial risks.

Duplication of customer data in different product/business environments also dramatically increases the cost of data verification from golden source data providers such as Credit Bureaus.

This is where AI comes in to enhance the quality of big data:

1. Data extraction

AI-powered algorithms can automatically extract relevant information from unstructured documents such as IDs, passports, utility bills and even a human’s Biometric data. The AI algorithms can accurately capture crucial details by analysing these documents or 3D facemaps to confidently determine if the human behind a KYC process on a digital device is alive and human while minimising human error.

2. Data validation and enrichment

AI can cross-reference customer data against multiple sources, databases, and watchlists, ensuring that the provided information matches credible records. Additionally, AI can enrich the data by identifying missing pieces and filling in gaps.

3. Risk assessment and pattern recognition

AI can analyse historical data and identify patterns associated with fraudulent activities. This enables companies to assess customer risk levels more accurately and detect suspicious behaviour quickly.

4. Continuous monitoring

AI can facilitate real-time monitoring of customer transactions and activities, flagging suspicious behaviour. This dynamic approach ensures that ongoing due diligence is maintained and potential risks are promptly addressed.

Four benefits of AI-enhanced data quality:

- Accuracy and consistency: AI-driven data verification reduces manual errors and ensures consistent adherence to compliance standards across all customer interactions.

- Efficiency and cost savings: Automation of data extraction, validation, and enrichment speeds up the verification process, leading to quicker customer onboarding and reducing operational costs.

- Enhanced risk management: AI’s ability to detect subtle patterns and abnormalities in data helps companies identify high-risk customers and potentially fraudulent activities more effectively.

- Adaptability to regulatory changes: As regulations evolve, AI systems can be easily updated to incorporate new compliance requirements, ensuring that the institution remains in line with the latest laws and regulatory standards.

- Automation and Greenline processing: By implementing AI to automate crucial yet repetitive security and identity processes, you can streamline expensive staff resource allocation to more business-related tasks, thus improving customer experience and the overall bottom line.

At Datanamix, we understand the importance of the value of high-quality data and that it is non-negotiable. Artificial Intelligence in the KYC data space is a true game-changer, offering innovative solutions to streamline data management processes, enhance accuracy, and strengthen risk assessment capabilities.

By embracing AI-driven data quality improvements, financial institutions can meet compliance obligations more effectively and foster a safer and more secure financial environment for themselves and their customers.

Customer experience is the new digital age game changer. If a customer can be onboarded and KYC done in seconds without compromising on security, then a digital business can thrive where others have failed.

Due diligence for KYC should never impact the customer experience and AI is the tool to solve that industry problem.