At pbVerify, we always strive to introduce new products and improve on existing ones to make our customers’ dealings as efficient and risk-free as possible.

pbVerify’s popular bank account verification service (AVS) has been upgraded to include more functionality, for a fraction of the previous cost.

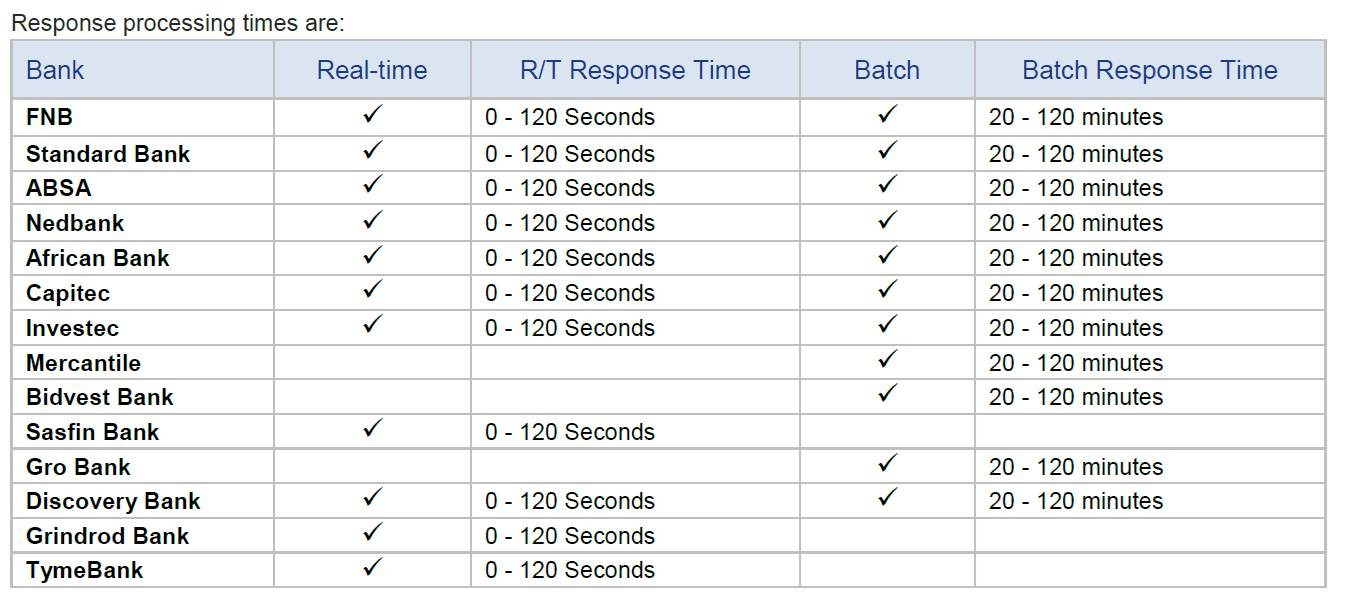

While our AVS product still has the same familiar, reliable look and feel our customers are used to, it now includes more than double the number of banks previously available, as well as an additional batch processing option, which enables batch verification via upload.

An established and widely-used risk management tool, pbVerify’s bank account verification service provides a platform that allows for the verification of consumer and business bank accounts across all participating banks, in a single and uniform process. Additionally, our AVS provides information around the status of the account, i.e. whether it is currently active, open or closed and whether it has been open for longer than three months.

How does pbVerify’s bank account verification service work?

As a user of pbVerify’s bank account verification service, you can verify a vast amount of data, with minimal information input.

To start, you will submit a file to PbVerify containing AVS requests (via a Host-to-Host connection) or individual account verification requests (via Web Services). These requests will be for the verification of accounts held at the multiple South African banks that participate in this service.

pbVerify will then validate the integrity of data. Any records failing validation will not be processed and will be treated as upfront rejections and returned to you, together with reasons for rejection.

The information file you submit includes name, account number and identification number of the consumer – or business registration number of the business. This will return the following verifications to you in a single report:

- That the account does in fact exist at the institution.

- That the individual or business is the rightful owner of the bank account (this is done through the verification of an ID number or company registration number against the bank account number supplied).

- That the bank account in question is presently open and active.

- That the bank account in question accepts debit and credit transactions.

- That the bank account in question has been in existence for a period exceeding 90 days.

- That the supplied contact email is the same as that hosted at the bank.

- That the supplied contact cell phone number is the same as that hosted at the bank.

Why is bank account verification important?

Bank account verification is hugely valuable to credit providers and other businesses that require a means of verifying the validity of a consumer or business bank account before making a pay-out, granting credit or activating debit orders.

The basic business requirement for the account verification mechanism is two-fold:

- Firstly, businesses making payments into numerous bank accounts have a need to verify that the account to be credited belongs to the intended beneficiary.

- Secondly, institutions that are mandated to process debit order collections against the accounts of their customers have a need to verify – prior to submitting the debit order instruction – that the debtor is indeed the owner of the account to be debited.

Ultimately, the aim of AVS is to ensure the integrity of the current creditor/debtor database, as well as the accuracy of any future amendments and additions to it, to mitigate fraud.

What are the benefits of bank account verification?

Beyond the prime purpose of bank account verification as a means of mitigating risk, there are several other benefits to be had from using this service. pbVerify’s AVS enables businesses to:

- Proactively detect fraud.

- Mitigate the risks associated with fraud, both financial and reputational.

- Shorten the time that is usually required to vet new business.

- Reduce costs by automating a process that is ordinarily largely manual.

- Enhance the integrity of stored data.

- Reduce the risk of unpaid transactions.

- Reduce query administration.

- Aid in ensuring legislative compliance.

- Get real-time responses on account verification queries.

- Use a single interface to carry out and access all bank verification processes, using uniform formatting and a single means of connectivity.

For more information on our products and pricing , call us on (0)10 300 4898 or email [email protected].