Money is the root of all stress – find out how to successfully apply for credit without compounding your anxiety levels.

Financial matters play a pivotal role in the health and happiness of consumers today. In fact, leading market and consumer research firm, GfK, found late last year that money was the biggest source of stress in the world.

When it comes to getting credit – something most modern-day consumers are bound to need at some stage in their lives – the processes involved can feel daunting, especially if one is already financially pressed. One of the best means of making the process as pain-free as possible, is to educate yourself from the get-go.

Borrowing and lending of money involves a number of aspects being in place, for the consumer and the credit provider, respectively. The consumer wants assurance of a successful loan or financing application, while the lending institution requires surety that the consumer that is applying for credit will be able to meet their financial obligations and deadlines.

So how do you, as a consumer, ensure the institution you are seeking a financial advance from views you as a valid candidate?

According to the largest wholly South African owned and registered credit bureau, XDS, the weight of the decision on credit eligibility for a loan, finance or credit ultimately depends on the consumer’s own attitude and behaviour toward their credit.

A good starting point for you as the consumer, when applying for credit, would be to fully acquaint yourself with credit scores. It is imperative that you know the fundamentals of your credit report and credit score before you even think of applying for credit.

Your credit score is calculated using the information contained on your credit report. According to South African credit bureau Compuscan, this includes account information, your payment history, adverse information, public records and enquiries (requests by credit providers to view your credit report).

Your credit score basically outlines all the factors, both negative and positive, that indicate how likely you are to honour your credit repayment obligations.

Some of the information on your credit report may include your payment history, how much debt you owe, the length of your credit history and new credit applications you have underway.

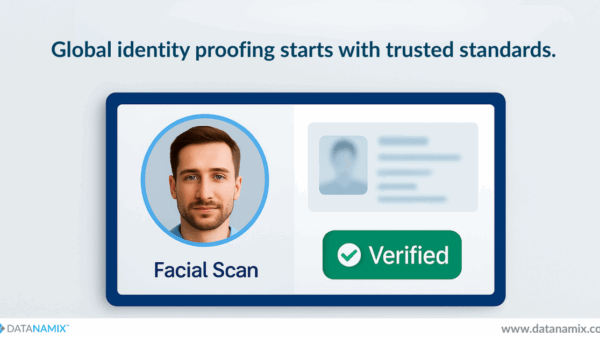

MYpbVerify

pvVerify’s consumer service, MYpbVerify, gives you instant online access to your personal (customisable) credit report. The service allows you to choose which personal credit information you want to view, and offers different pricing options.

Depending on your status and credit history, you have the option to choose from a Basic credit report to more advanced options in the Standard and Premium reports that will include Directorship information, Deeds (properties owned) data, your personal Compuscan credit rating score and more.

Our Basic report, priced at just R29, includes essential information for you to assess your personal details, employment details and adverse information. R 29.00

The Standard credit report (R39) includes the basic report, plus an in-depth look at your credit accounts, payment history and CompuScore rating.

The most in-depth report, the Premium report, costs R49 and combines the Basic and Standard reports, plus an in-depth look at property you own and company Directorships.

With all of these affordable options and access to all the major credit bureaux, MYpvVerify is truly the most versatile online personal credit check available.

Money matters

Once the crucial first step of getting to know your personal credit score is under your belt, you’re well on the way to finalising your credit application or applications and gaining access to the money you need, short- and long-term.

Good practices to bear in mind, too, would be to limit the number of credit applications you launch at one time; be ready with historical information on hand that will prove you are able to make good on debt repayments and make sure you fully understand credit terms and conditions (as these can be tricky). Remember, when you sign on the dotted line, you are saying “I agree to all the terms and conditions contained in this contract” – and you will be held liable should anything go awry.

Money matters matter. To almost every aspect of your life – health, happiness, relationships and business. Make sure that, when it comes to the inevitable task of applying for credit, you are well equipped and educated on your personal credit score. You will be doing yourself – and your stress levels – a huge favour.

References:

GfK: http://www.gfk.com/

pbVerify: https://www.datanamix.com/

Compuscan: https://www.compuscan.co.za/