For SMEs, sound risk management via credit vetting is not only advisable, it is absolutely essential.

Wasting precious time and resources chasing down debtors for money is not only undesirable for any business, it can be downright destructive. The good news is, there is a way to avoid this – and it is inexpensive and painless. Two words: credit check.

If you are in business, you will know that cash flow is king. This is especially true in the in the small to medium enterprise (SME) environment, where finances are particularly tight. Clients that default on payments can – and inevitably do – seriously jeapordise the success of your company.

A foolproof way to protect your business – and ultimately boost its financial fitness – is through consistent credit vetting.

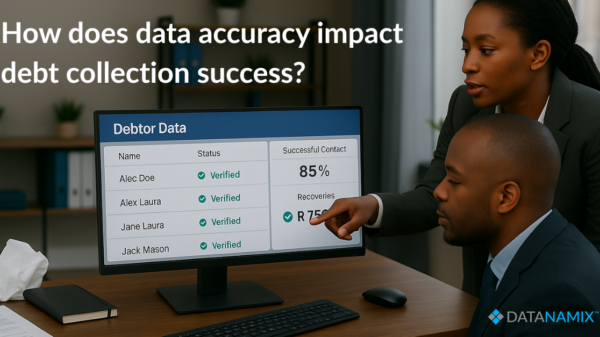

Credit vetting is simply the process of affirming the credit worthiness of customers in terms of financials. Checking the credit status of your clients greatly minimises uncertainty around whether your invoices will be paid, as it provides an overview of their credit rating and reveals whether there are any judgements against them, or whether they have defaulted on payments in the past.

Simple step towards success

According to Leon van der Merwe, senior business development manager at customer communications firm PBSA, the percentage of small simply overlooking this critical process is staggering.

“Simply taking the steps to check the credit status of companies and directors before doing business with them is straightforward, very affordable and it could make all the difference.”

A detailed credit application document with the correct capture information, credit vetting consent and related terms of agreement will protect the financial wellbeing of your organisation, he adds.

All of this can be easily accessed via pbVerify, a PBSA product that offers a user-friendly online credit vetting service. Specifically for small to medium sized businesses, pbVerify is connected to all major credit bureaux and credit data providers and is credible and accurate.

“Neglecting this crucial step towards managing a successful business can cost you profoundly. Having an overview of the credit worthiness of potential customers, on the other hand, will help you make better decisions, in turn saving you time, trouble and money,” concludes Van der Merwe.

For a comprehensive view of all pbVerify’s vetting solutions, please visit www.www.datanamix.com