Years of investigation into anti-spoofing agents, such as age estimation, has resulted in watertight facial recognition software.

Years of delving into one of the fastest-growing ID authentication biometric technologies since fingerprint scanning – facial recognition technology – has resulted in a liveness detection service with so many facets, that it is now spoof-resistant.

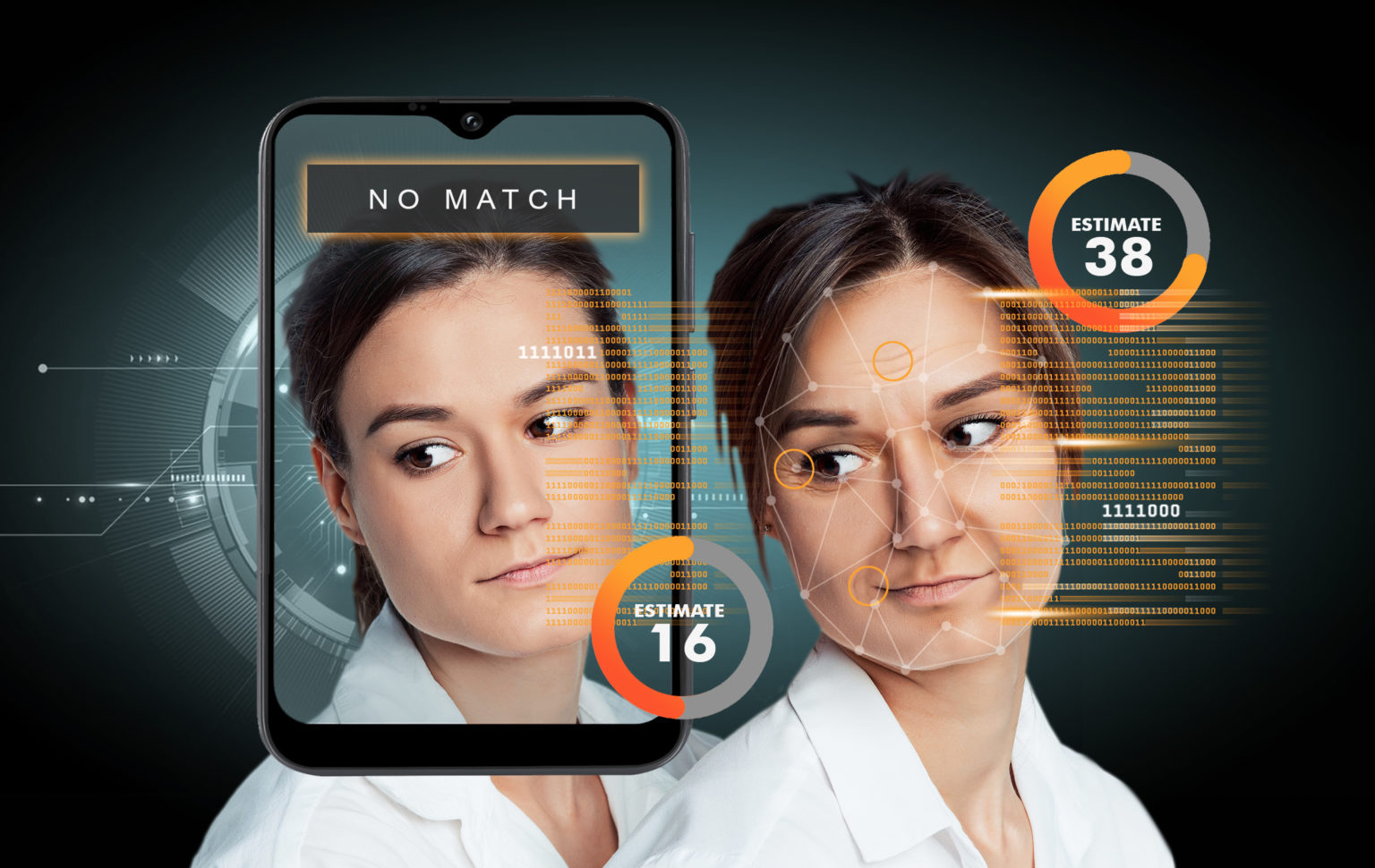

One of the more recent developments honed by liveness and 3D face matching leader, FaceTec, is Age Check (Age Estimation). Without the need for an ID photo, FaceTec Age Check estimates the age of an individual using 3D face mapping.

Age Estimation is performed with every liveness check, enrolment, authentication, and photo ID match, and – together with other data verification points proven by FaceTec’s technology – yields the most accurate and trusted results in the market today.

In addition, because the 3D FaceMap is all that is needed for Age Check, the process can be completely anonymous. Age Check can also be used to corroborate the date of birth shown on a photo ID.

FaceTec, which owns the only 3D face authentication software in the world that is iBeta Level 1 and Level 2 certified, and that is backed by a $100 000 Spoof Bounty Programme, says it is committed to continuous improvement to age checking practices. “Our algorithms will continue to improve over time.”

Facial recognition growth

The use of age estimation in facial biometrics has gained popularity among government agencies and corporates alike over the past few years, with new use cases being discovered on a regular basis.

It is estimated that 2021 will see facial recognition, which includes age estimation data, in use at the top 20 US airports for 100% of international passengers, including American citizens.

Locally, emerging biometric technologies have become ubiquitous across many parts of Africa, with facial recognition meaningfully deployed in South Africa, Zimbabwe and Uganda. At the moment, the technology is used primarily to help combat identity theft, fraud and terrorism threats.

Commercially, banks have proven to be early adopters with the implementation of eKYC solutions for onboarding processes, and more and more manufacturers are including face recognition in their products, such as Apple with its Face ID technology.

Age estimation services, specifically, are becoming more common due to their ability to strengthen authentication and system security to prevent impersonation attacks. Facial security checks are able to prevent bank card cloning, fraudulent exam takers, and identity theft. Age estimation can also be used for adult entertainment venue access, and purchase of age-restricted goods.

Try the FaceTec Age Check demo for browser and mobile browser HERE.

References

- pbVerify – FaceTec 3D Proof of Life

- Spoofbounty.com – What is a spoof bounty program?

- pbVerify – FaceTec 3D Liveness software enables frictionless, secure transacting

- Defence Web – Future of facial recognition in Africa

- Forensics and Security – Evaluating automated facial age estimation techniques for digital forensics